From this we can learn of a new and important advantage that exists in the Forex market – this market is stable, and I'm referring mainly to the major currencies: Euro, USD, Pound, Yen and Swiss Franc.

This is a stable market, with exchange rate fluctuations of half a percent up to one and a half percent throughout the day. There is no possibility that you will trade a currency and lose 10%-15% in one day.

Value of pips

Let's now learn the value of every pip within the confines of a particular transaction. If the exchange rate of the EUR/USD is 1.5220 and you want to buy 100,000 Euros, how many USD do you have to pay? 152,200 USD, of course. A second passes and the exchange rate rises to 1.5221. By how many pips did the exchange rate rise? By one pip. And what is the current value of the 100,000 Euros? 152,210 USD. Which is 10 USD more.

The value of one pip in a transaction of 10,000 Euros is one USD.

In other words: In a transaction of 100,000 Euros, each pip has a value of 10 USD.

And in a transaction of one million Euros – 100 USD.

How are pips calculated?

We take the amount of the transaction that we have performed in terms of the base currency and divide by 10,000 – this is the value of one pip in terms of the counter currency.

For example: For a transaction of 100,000 Euros we divide by 10,000, and we get 10. This means that the value of every pip is $10.

If we execute a transaction of 30,000 Euros, every pip worth is 3 USD. For the Japanese Yen the calculation is slightly different. We divide the amount of the transaction in terms of the base currency by 100 and that is the value of the pip.

For example: A transaction of 100,000 USD in the currency pair USD/JPY, we divide by 100 and the result is 1,000 Yen. Assuming that the exchange rate is 88.00, we divide the 1,000 by 88, meaning, 11.36 USD per pip.

Example: We will take the currency pair of EUR/GBP and a transaction of 100,000 Euros, each pip is worth 100,000 divided by 10,000 and is therefore worth 10 USD. And in what currency are we paying in? In Pounds. Meaning that every pip is equal to 10 Pounds.

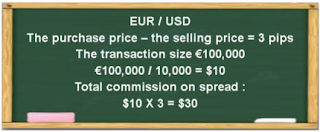

Size of the spreads

Do you know what the accepted ask/bid spread is for the EUR/USD exchange rate? 3 pips.

So in order to perform a transaction of 100,000 Euros, which is equal to 152,000 USD how much commission must one pay?

If every pip is equal to 10 USD in a transaction of 100,000 Euros, and the spread is 3 pips, we will pay 30 USD in commission – a onetime payment which includes the purchase and the sale.

Commissions

If to compare the commissions rate paid in the stocks market we will notice that in the Forex market the commissions rate are very low.

For example, in a 10,000 Euro trade the stock's commission is half a percent hence 50 Euro. In Forex however you will pay only 3 USD commission for a 10,000 Euro trade, for a 100,000 Euro trade you will pay only 30 USD commission and so on and so forth.

Trading rules

If you trade a certain product, and you think that its price will rise, you will buy it and if its price indeed rises, you will profit when you sell it, and if you are wrong and its price goes down, you

will lose.

For example, if you trade wood, and you think the wood

price will rise, you buy 10 tons of wood when the wood

price is 100 USD per ton. And later you sell it when the

price rises to 150 USD per ton, you have profited 500

USD.

If you thought that the wood price would decrease,

you would wait until the price reached 50 USD per ton,

and then you would have bought the same 10 tons at

only 500 USD.

The rules are:

A trader who thinks the value of his product is going to rise, buys more goods and waits for the price to rise in order to sell.

A trader who thinks that the value of a product is going to fall, rushes to sell the goods and make the most of his money.

Traders do not always have to lose everything or gain everything, the trade can be stopped in the middle, and such a situation will be expanded upon further later.

Let's translate this into terms of Forex market:

If you expect the exchange rate of a currency to rise, you will buy it.

If you expect the exchange rate of a currency to drop you will sell it.

The sum which you profit or lose depends on the volume of the transaction which you perform. The greater the transaction is, the more you can profit, but you will take on a greater risk and the smaller the transaction is, the smaller the profit will be but you will have taken on a smaller risk. Trading currencies is exactly like buying and selling wood, tomatoes or cucumbers. We buy the goods when we think the price will rise, and we sell the goods when we think the price will fall.

Transaction / Position

In order to complete a transaction we need to perform a purchase and a sale. If a purchase and a sale were not performed, then the transaction was not completed, and it doesn't matter if you are going to gain or lose in the course of the transaction.

Remember, this is an important rule: realization of the gain or loss occurs only when the transaction is complete.

Position is in essence a transaction.

Opening of the position - opening of a transaction for a currency pair.

Open position – a position which hasn't yet been closed, in other words, the transaction has not yet been completed.

Closed position – a transaction which has been completed, the actions of purchase and sale have been performed.

Leverage

What changes the whole picture, and turns the Forex market into a market of opportunities to profit a lot of money in a short span of time, is leverage.

But…of course, leverage causes trading to become more risky.

So what is leverage?

Brokers allow you to perform transactions in sums of money which are much larger than the amounts that you have in your account. Sometimes even up to 400 times more than what you have invested.

For example: You have deposited 1000 USD, the exchange rate of the Euro against the USD is 1.5220. And you believe that the price of the Euro is about to rise by 100 pips. That is your opinion.

You can pick up the phone and call the broker or give an order via the computer, 24 hours a day “please buy me 100,000 Euros”

Despite the fact that you have deposited 1000 USD and 100,000 Euros cost 152,000 USD, in this case you have taken advantage of a leverage of 152 times the money which you have in your account.

In a transaction of 100,000 Euros, how much is each pip worth. We learned it already, remember? 10 USD. Let's assume that the exchange rate indeed rose to 1.5320. How many pips have you earned? 100. And how much money have you earned? 100*10 = 1000 USD.

Let's deduct the commission, and the net profit from the transaction will be 970 USD.

Nearly a 100% return in one day. How great!

But… what will happen if the exchange rate falls to 1.5120?

You have lost 100 pips, you have lost all of your 1000 USD.

Should you leverage?

Later on you will learn whether it is worthwhile to leverage your transactions and by how much. But one must always remember, for whoever wants to leverage – the option is always available, but it's risky.

When there is a leverage of 300 times you can perform a transaction of 300,000 Euros as well, and if the price rose by 100 pips, you can even earn a 300% return in one day. But if the exchange rate decreases by 33 pips, you have lost your whole investment.

Why do the firms allow us to leverage?

The answer is simple: It is preferable for

them that we perform a transaction

of one million Euros rather than

of one million Euros rather thana transaction of 10,000 Euros,

in this way the broker earns

a commission of 300 USD

and not 3 USD.

Later on you will learn

what your interest is as

traders, and why you

shouldn't be tempted to

leverage transactions.